Table of Contents

FINMA claims to provide guard rails for financial innovation. But when innovation creates new ways to harm investors, those guard rails collapse into a smoke screen — and harmed users are dismissed as collateral damage.

The Promise of Guard Rails

The Swiss Financial Market Supervisory Authority (FINMA) often highlights its role in fostering innovation. Switzerland, they say, is an attractive hub for financial innovation with guard rails in place to protect the public.

The metaphor is powerful: drivers can speed ahead, explore new ideas, and build new products — all within the safety of clearly marked boundaries.

But when the road is actually full of hidden traps, guard rails become stage props.

The Smoke Screen Effect

In practice, guard rails exist more in speeches than in enforcement. They give the public a sense of safety, but when tested, they fail.

- Investors are told their money is secure under Swiss oversight.

- Firms showcase FINMA’s approval to bolster credibility.

- Regulators reassure the public that risks are “contained.”

Yet when products like Nexo AG’s undisclosed margin accounts implode, the guard rails vanish. Investors discover that “protection” was never real — only the illusion of oversight.

Innovation as Harm

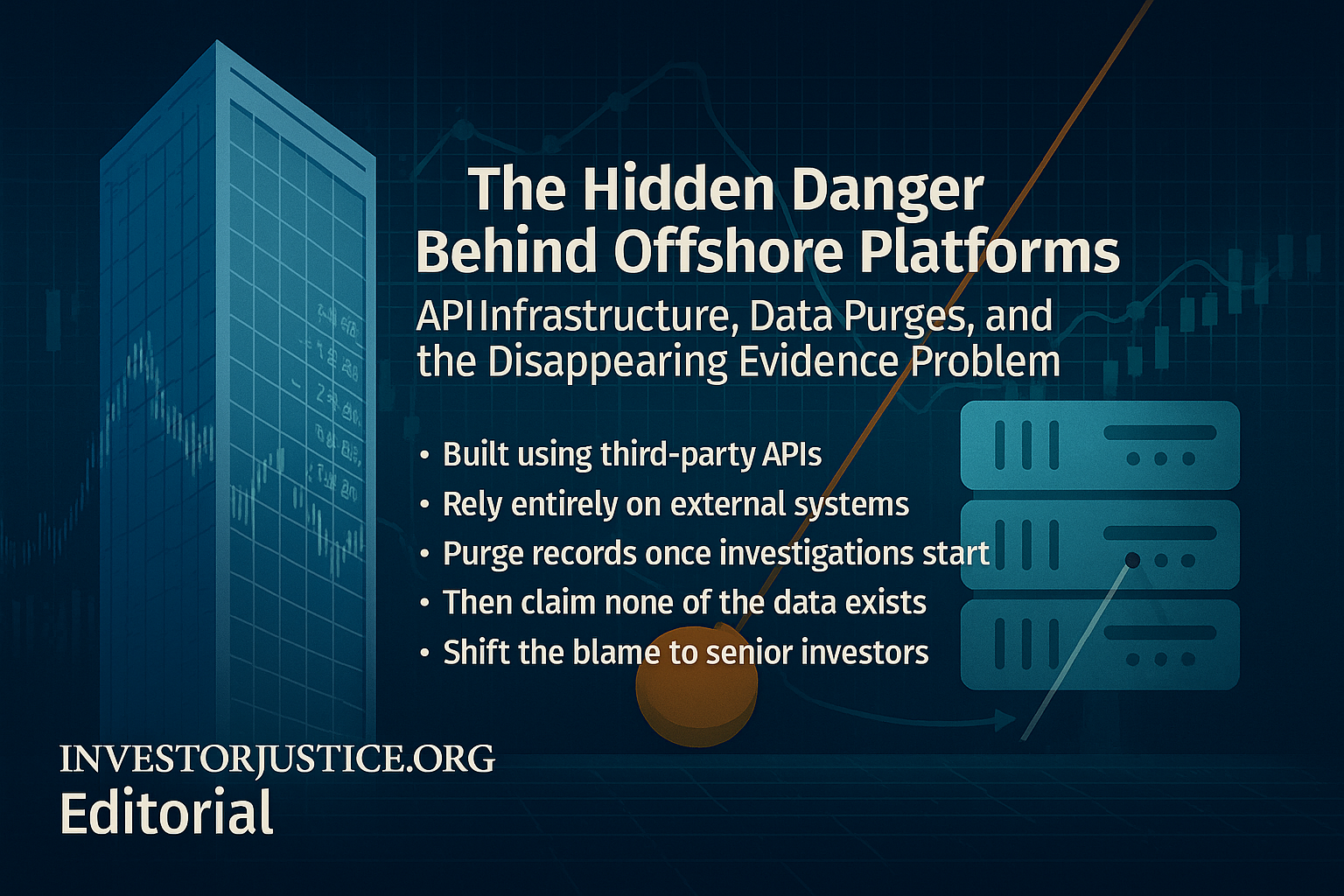

Innovation is not inherently good. In finance, innovation often means finding new, clever ways to extract value from users without them realizing the risk.

Examples include:

- Structuring accounts as margin loans without disclosure.

- Engineering liquidation engines that profit from forced sales.

- Using vague terms of service that shift risk entirely to the user.

- Bypassing accountability by registering in Cayman while marketing Swiss credibility.

Without real enforcement, FINMA effectively incentivizes harmful innovation. The industry is rewarded for cleverness, not fairness.

Collateral Damage Mindset

When investors lose everything, FINMA frames it as “market risk.” But that is a misdirection.

What happened to retirement-age savers wiped out by undisclosed margin accounts was not ordinary market volatility, it was structural harm enabled by regulatory indifference.

By prioritizing Switzerland’s reputation as a fintech hub, FINMA implicitly accepts that harmed investors are collateral damage.

What Real Guard Rails Would Look Like

If FINMA’s metaphor were real, guard rails would:

- Ban undisclosed margin structures.

- Require clear liquidation risk warnings in plain language.

- Ensure access to recourse when accounts are misrepresented.

- Intervene before harm occurs, not after it is irreversible.

Instead, the current framework prioritizes growth and innovation at all costs, even if that means leaving investors unprotected.

Think about it, ...

Guard rails that collapse under pressure are not guard rails, they are a smoke screen.

Until FINMA proves it can enforce its own standards, Swiss investors will remain unprotected, and “innovation” will be little more than a license to harm.

📄 Related Reading:

📥 Contact: investorjustice@proton.me