Table of Contents

Respondents: Nexo AG; FINMA; U.S. SEC

Dossier: /case-2025-000001/

All posts: /tag/case-2025-000001/

Status: Open

Last updated: October 3, 2025

Open Letter to FINMA and the Public

Subject: FINMA Must Enforce the SEC–FINMA MOU and Restore Cross-Border Investor Confidence

To the leadership of FINMA and all stakeholders in international regulatory cooperation:

I am a retirement-age U.S. citizen who suffered life-altering financial harm from a product now ruled unlawful by the U.S. Securities and Exchange Commission (SEC). For over two years, I have sought resolution through Swiss legal and regulatory channels—without success.

This is no longer a personal dispute. It has become a test of the credibility and purpose of bilateral enforcement agreements.

Established Facts

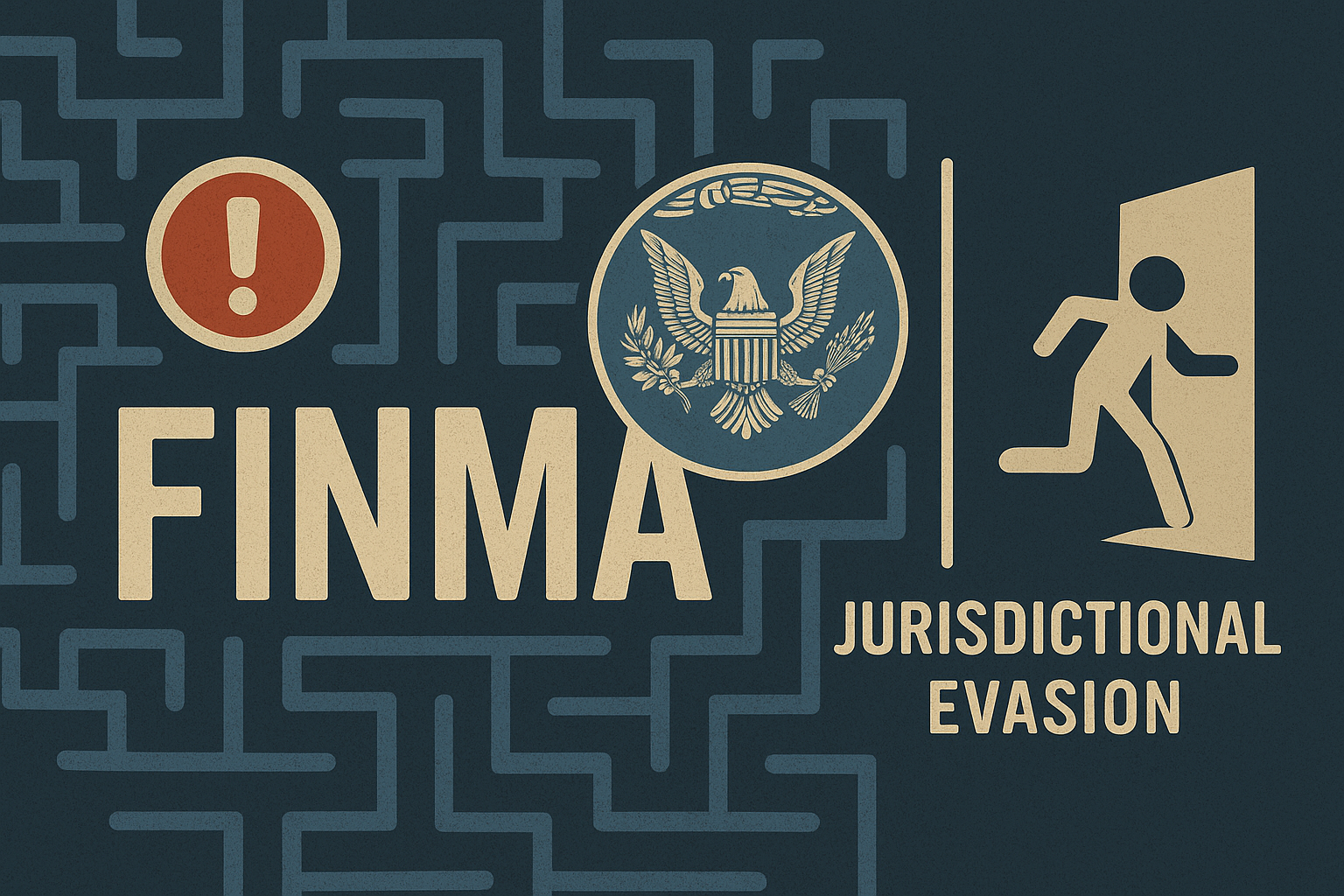

- A binding Memorandum of Understanding (MOU) exists between the SEC and FINMA for coordinated oversight of cross-border financial activity and investor protection.

- This MOU is active and operational. It is not symbolic—it creates enforceable obligations on both sides.

- The SEC has formally determined that Nexo’s Earn Interest Product (EIP) was an unregistered security. This was the product that initially enticed me to become a Nexo customer.

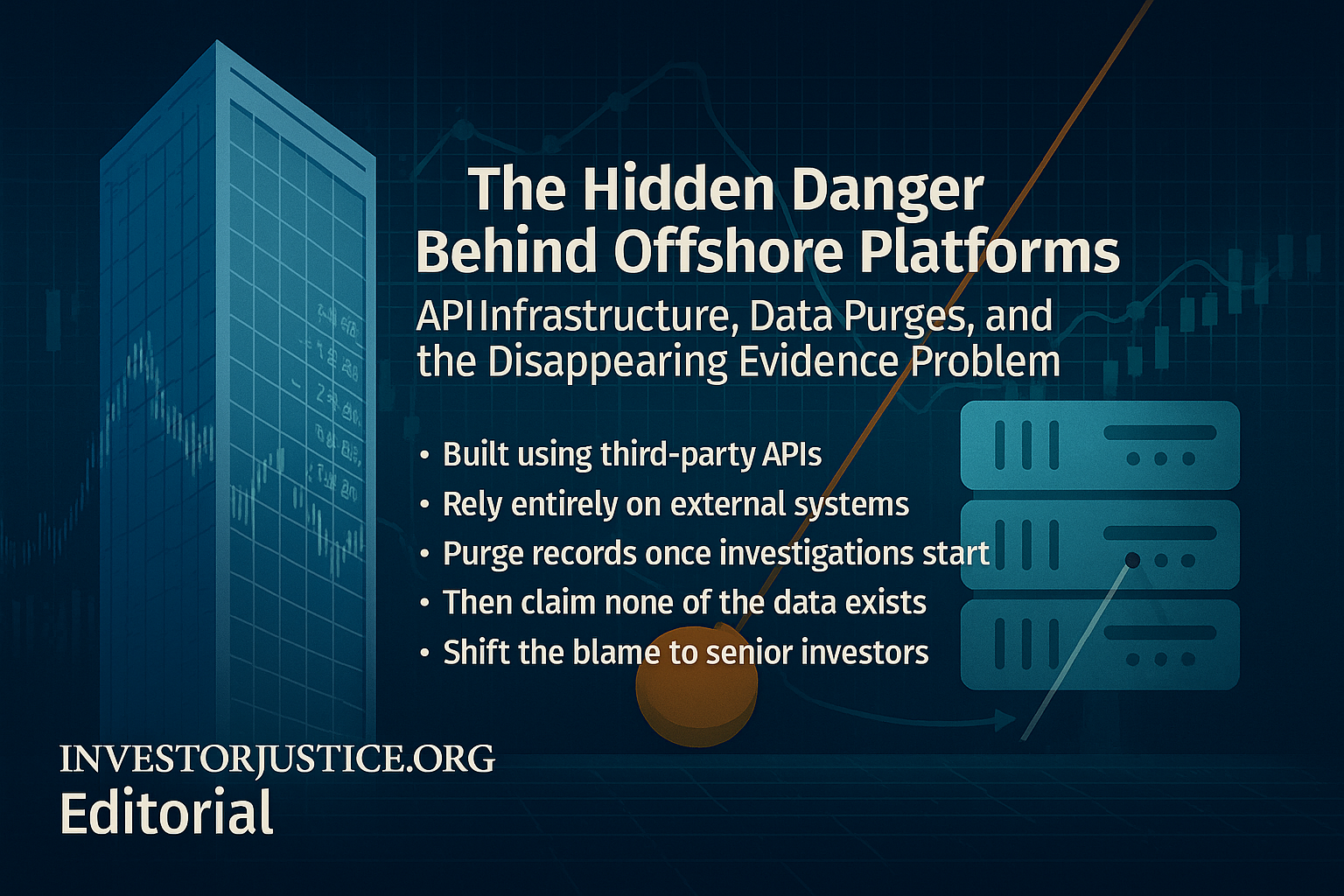

- My losses, however, stem from another Nexo offering—marketed as a secure APR credit line backed by collateral—that was, in reality, a margin account subject to forced liquidation. This product, known as the “Credit Line,” was not addressed in the SEC’s cease-and-desist order.

- Nexo AG is a Swiss-registered entity. FINMA had both visibility and jurisdiction, yet issued no guidance, warning, or supervisory response—leaving foreign investors like myself exposed.

- FINMA’s inaction facilitated jurisdictional evasion and prolonged harm, allowing Nexo to trade on the reputation of Swiss regulation while evading meaningful scrutiny.

The Ongoing Harm

- I now face long-term financial instability and documented health impacts resulting from unresolved losses.

- Every failed attempt at justice erodes trust—not only in Nexo, but in the reliability of Swiss oversight itself.

- The systemic implications are serious: if Swiss jurisdiction is perceived as a safe harbor for regulatory evasion, investor protection globally is weakened.

Call to Action

I respectfully call on FINMA to take visible and corrective action by:

1. Engaging Nexo AG under supervisory authority.

- Clarifying regulatory expectations concerning the treatment of retirement-age investors.

- Cooperating with U.S. counsel and Swiss legal representatives to enable timely redress.

The SEC–FINMA MOU exists for precisely this type of case. Its effectiveness must be measured not by its language, but by its enforcement—especially when abuse crosses borders and harms vulnerable investors.