Jurisdictional Evasion Is Not a Shield: Why Obstruction Amplifies Liability, Not Limits It

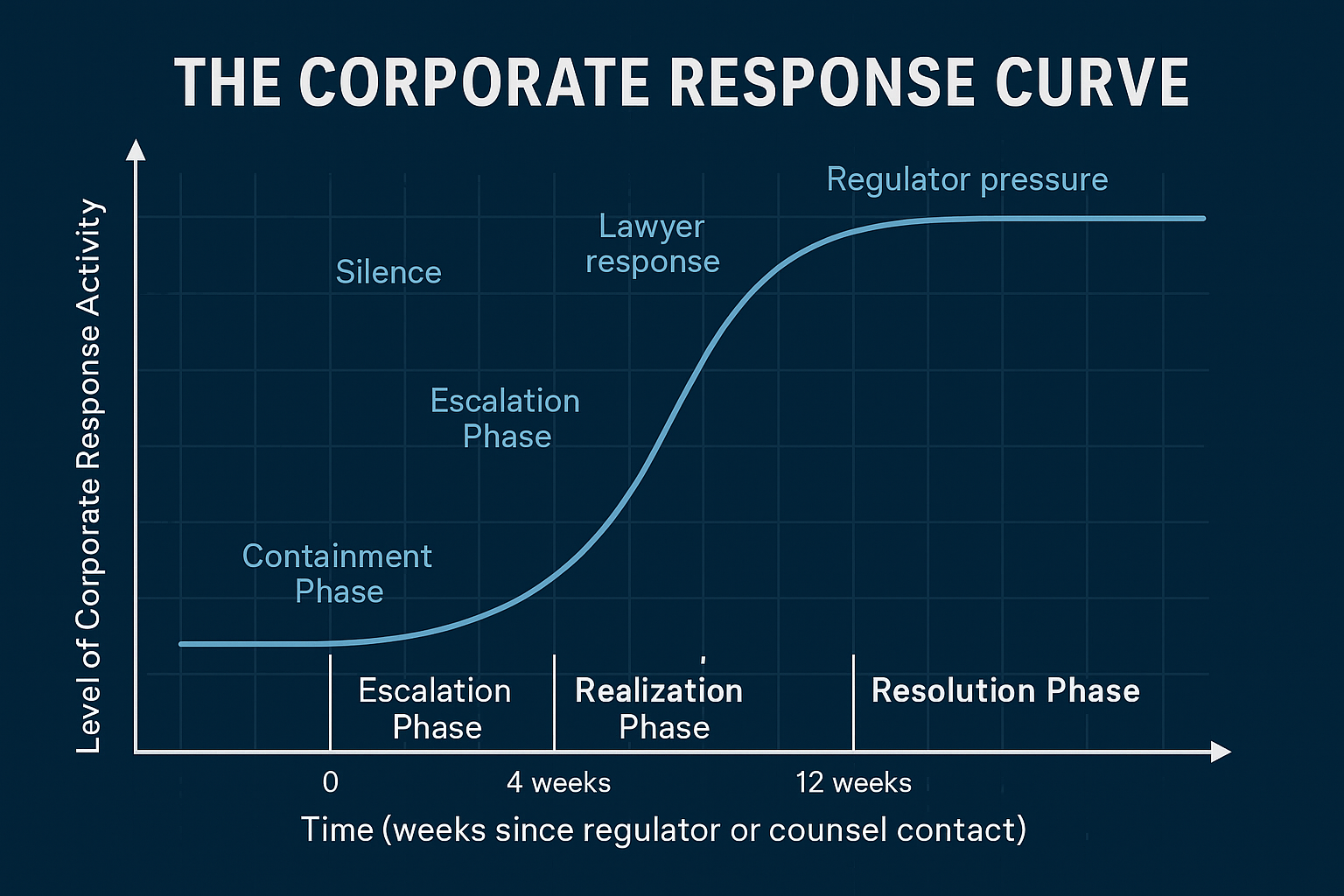

Offshore routing and data refusal don’t shield financial platforms, they signal risk. Regulators treat evasion, contradictory statements, and shell detours as evidence of obstruction and potential misconduct, increasing rather than reducing liability.