Table of Contents

Introduction: The Shift from Defense to Design

Corporate governance is undergoing a quiet revolution.

The age of purely defensive lawyering, where the primary goal was to minimize exposure and delay accountability, is giving way to a new paradigm: transparency as strategy.

This is not a moral awakening so much as a survival instinct.

In an era of real-time scrutiny, regulatory collaboration, and digital transparency, concealment has become costlier than disclosure.

The organizations that endure are those that treat governance not as a legal fortress, but as a living system of accountability.

Defensive Lawyering: A Culture of Containment

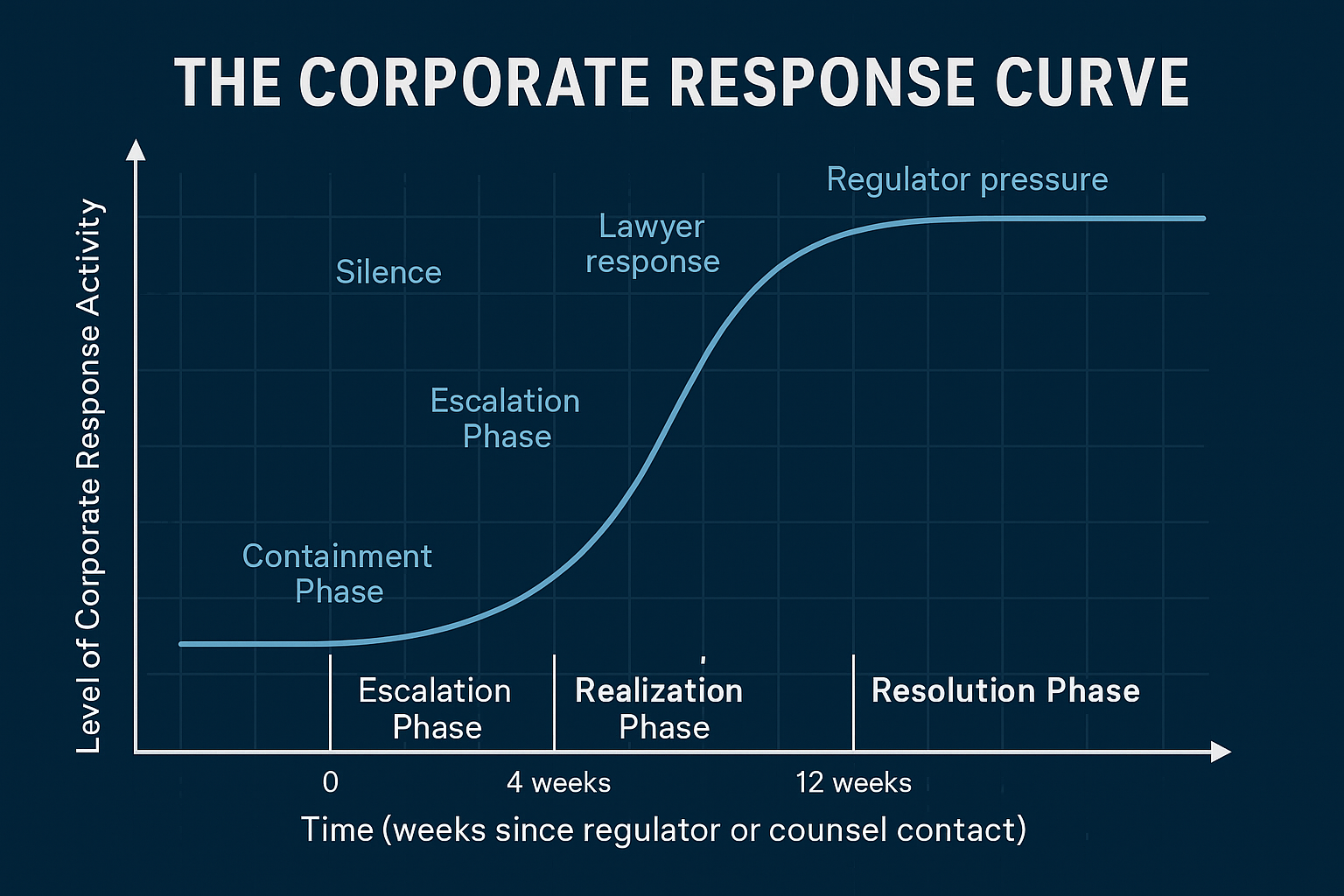

For decades, the default posture of corporate legal departments has been containment.

Every crisis, every investigation, every inquiry was met with a familiar reflex:

- Limit disclosures.

- Control the narrative.

- Mitigate liability at all costs.

This posture worked, when information moved slowly.

But in the hyperconnected economy, where regulators, investors, and journalists can trace inconsistencies within hours, containment breeds distrust faster than it buys time.

Defensive lawyering often achieves its immediate objective (avoiding short-term loss), yet sows the seeds of long-term failure.

The organization survives the incident but loses credibility.

And credibility, once lost, is rarely recovered through legal precision alone.

The Transparency Pivot

The emerging model is not about surrendering control, it’s about changing the purpose of control.

Progressive institutions are now re-engineering governance systems around three core principles:

- Disclosive Reflex — When in doubt, disclose early. Preemptive transparency builds narrative control through authenticity, not spin.

- Collaborative Compliance — Treat regulators as ecosystem partners, not adversaries. Co-regulation builds trust and reduces punitive escalation.

- Ethical Predictability — Develop clear internal standards that transcend minimum compliance and demonstrate consistent moral logic.

These are not abstract ideals, they are pragmatic adaptations to survive in an environment where opacity is punished by markets as much as by regulators.

From Risk Aversion to Trust Engineering

Transparency is no longer a liability, it is an asset.

In capital markets, reputation now directly affects valuation.

Investors price governance performance the way they once priced growth.

That shift has forced boards and executive teams to reconsider the purpose of their legal and compliance functions.

The best companies are no longer asking, “How do we defend ourselves if this becomes public?”

They’re asking, “What do we gain by being the first to make this public on our own terms?”

The old model saw compliance as an expense.

The new model sees it as a trust engine, a mechanism to reinforce credibility, attract patient capital, and lower long-term risk exposure.

The Case for Proactive Governance

A proactive governance model is built on the premise that sunlight is cheaper than litigation.

By aligning legal and compliance functions with communication and data transparency, organizations can:

- Detect reputational risk before it becomes legal risk.

- Build internal reporting pathways that encourage early disclosure.

- Reduce the adversarial gap between compliance officers and business units.

This approach converts what used to be reactive fire drills into structured resilience.

It doesn’t eliminate crises, but it ensures they’re survivable.

The Investor Justice Perspective

At InvestorJustice.org, we view this shift as both inevitable and necessary.

Defensive lawyering was the product of a slower era, one where information asymmetry favored institutions.

That asymmetry has collapsed.

Today’s public expects visibility, traceability, and explanation.

Regulators are learning to reward transparency instead of punishing imperfection.

And investors, burned too often by opaque failures, now demand governance that proves integrity, not just profitability.

The organizations that thrive in this new era won’t be the ones with the best legal defenses, they will be the ones with the clearest conscience and the most open data.

The Future of Corporate Integrity

The future of compliance is empathy.

The future of law is candor.

The future of governance is design; systems built to reveal, not conceal.

Rebuilding the balance means reimagining what the legal function exists to do:

Not to hide, delay, or deflect but to empower, explain, and ensure fairness.

This is not less law. It’s better law.

Law that stabilizes markets by stabilizing trust.