Table of Contents

Introduction: The Pattern Behind the Curtain

Corporate collapses and settlements rarely appear spontaneous.

From the outside, they look like sudden capitulations, a company “finally giving in” after months of silence.

But inside the organization, the decision to settle follows a remarkably consistent pattern; a psychological and structural progression that repeats across industries, from finance to tech to energy.

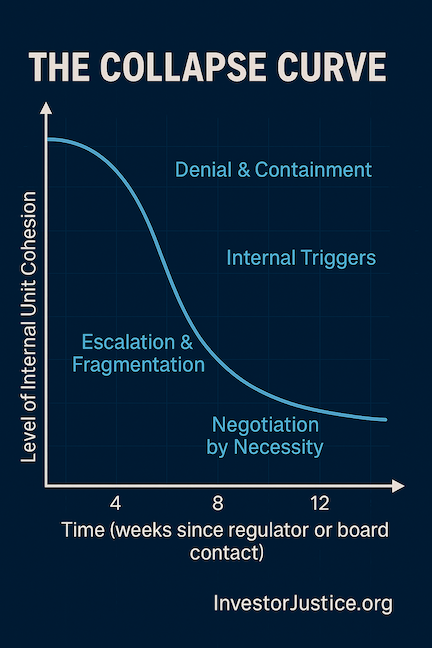

This is the collapse curve: a predictable trajectory from denial to disclosure, where internal self-preservation, not contrition, drives resolution.

Phase One: Denial and Containment

Every corporate crisis begins with disbelief.

Leadership frames the issue as a misunderstanding or miscommunication. Legal and communications teams lock arms to “control the narrative.”

The first instinct is to minimize scope:

- “This doesn’t rise to enforcement.”

- “The regulator misunderstood.”

- “We’re reviewing internally.”

Containment is the first defense. The goal is to keep the problem smaller than it is, at least long enough for the news cycle to move on.

Inside the company, lawyers quietly begin information triage, deciding what to disclose and what to bury under the shield of “privileged legal material.”

Phase Two: Escalation and Fragmentation

As evidence mounts, denial fractures.

Different departments begin to interpret risk differently. Compliance may push for cooperation; legal insists on silence.

This is when the alignment breaks, the moment when protecting leadership diverges from protecting the institution.

Communications may want transparency to preserve brand trust. Legal may want delay to preserve control.

Compliance, often the smallest voice, begins warning: “This could get worse.”

From the outside, the company appears frozen. Internally, it’s chaos, an invisible tug-of-war between risk, reputation, and responsibility.

Phase Three: Internal Accountability Triggers

At this stage, a few key events often force acceleration:

- Board Intervention: A board member demands a briefing, signaling loss of leadership control.

- Regulatory Confirmation: A government inquiry or external communication arrives, validating the issue.

- Leak or Media Exposure: Journalists or whistleblowers make internal stalling untenable.

Each of these events collapses plausible deniability. Suddenly, the cost of maintaining silence exceeds the cost of settlement.

This is when the compliance override begins, when the legal moat gives way to institutional survival instincts.

Phase Four: Negotiation by Necessity

When the collapse curve hits its steepest point, negotiation stops being a strategy and becomes a lifeline.

The same company that once ignored correspondence now floods regulators with cooperation letters.

Settlement discussions begin under the guise of “efficiency” or “resolution,” but the motivation is existential, not ethical.

Leadership realizes that controlling the outcome is more valuable than pretending there’s no problem.

At this stage, financial exposure is measurable; reputational damage is not.

A quiet, private settlement becomes the optimal solution for both sides.

Phase Five: Resolution and Reinvention

Once a settlement is finalized, the corporate narrative shifts overnight.

Public statements emphasize “commitment to compliance,” “learning opportunities,” and “enhanced internal controls.”

Internally, leadership rewards the same teams that caused the crisis for “managing risk successfully.”

But what appears as resolution is really rebranding.

Very few organizations address root causes. Instead, they rebuild the same structures that will inevitably lead to the next collapse.

The curve resets and the cycle begins again.

Why the Curve Predicts More Than It Explains

The collapse curve is not just a postmortem framework, it’s predictive.

By identifying where a company sits on this trajectory, regulators and advocates can anticipate when settlement pressure will peak.

Patterns to watch:

- Escalating compliance language in press releases.

- Leadership turnover framed as “strategic realignment.”

- Increased use of the word “transparency” without actual disclosure.

Each signal marks movement along the curve toward institutional self-preservation.

The Investor Justice Perspective

At InvestorJustice.org, the goal is not to celebrate settlements but to illuminate the mechanisms that make them inevitable.

When truth depends on internal politics instead of public duty, accountability becomes optional.

Understanding the collapse curve helps regulators, journalists, and citizens see beyond corporate press releases and recognize when the walls are already cracking.

Because no matter how fortified the fortress, every organization built on concealment eventually collapses from within.

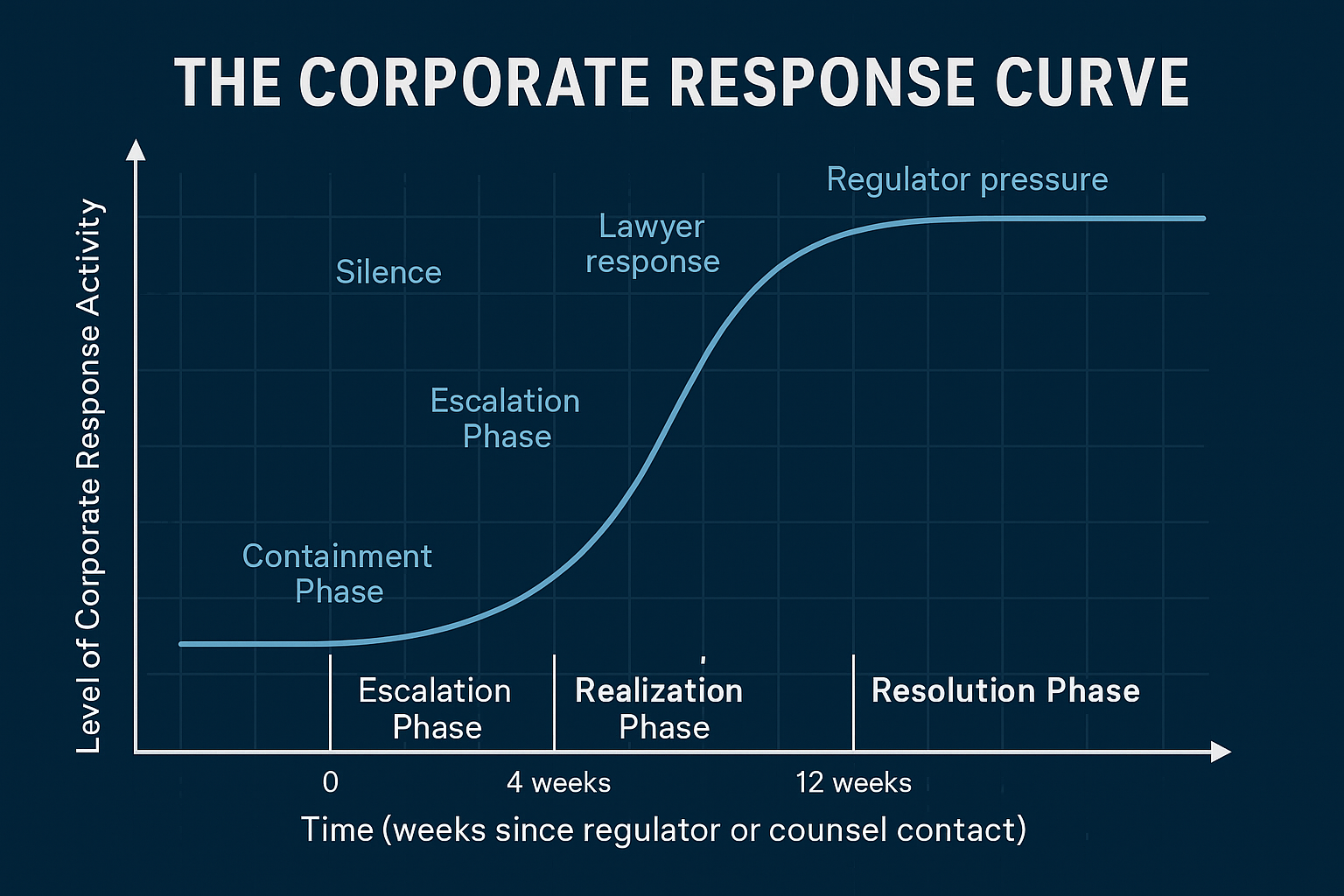

For a visual breakdown of how corporate behavior evolves from denial to settlement, see The Corporate Response Curve.