Table of Contents

Why This Series Exists

Behind every major corporate scandal, collapse, or settlement lies the same invisible machinery, a system of legal shields, risk buffers, and internal politics designed to delay accountability.

InvestorJustice.org created The Corporate Dynamics Series to help readers understand how that machinery actually works.

This is not about one company or one case. It’s about the recurring pattern where legal containment, executive distance, and profit-maximizing cultures collide with the boundaries of law and ethics.

By exposing these patterns, we aim to show that misconduct is rarely an accident.

It’s the predictable outcome of structures built to protect profit before people.

What This Series Covers

Each installment explores a different layer of the corporate accountability ecosystem from the way legal departments manage risk to how compliance and governance ultimately determine whether the truth surfaces.

Upcoming and Featured Articles

- When Legal Loses Control: How Compliance Overrides Shape Corporate Settlements

When legal containment fails, accountability begins. This article explores how compliance and risk override corporate legal shields and force leadership to confront governance realities. - The Firewall Fallacy: How Corporate Legal Shields Collapse Under Regulatory Sunlight

A deep look at the myth of plausible deniability and how regulatory transparency unravels the protective fog between leadership and liability. - The Liability-First Culture: Why Profit Structures Outpace Ethics

How executive compensation, short-term metrics, and shareholder pressure create blind spots that legal departments can’t permanently defend. - The Architecture of Delay: Inside the Corporate Playbook of Deflection

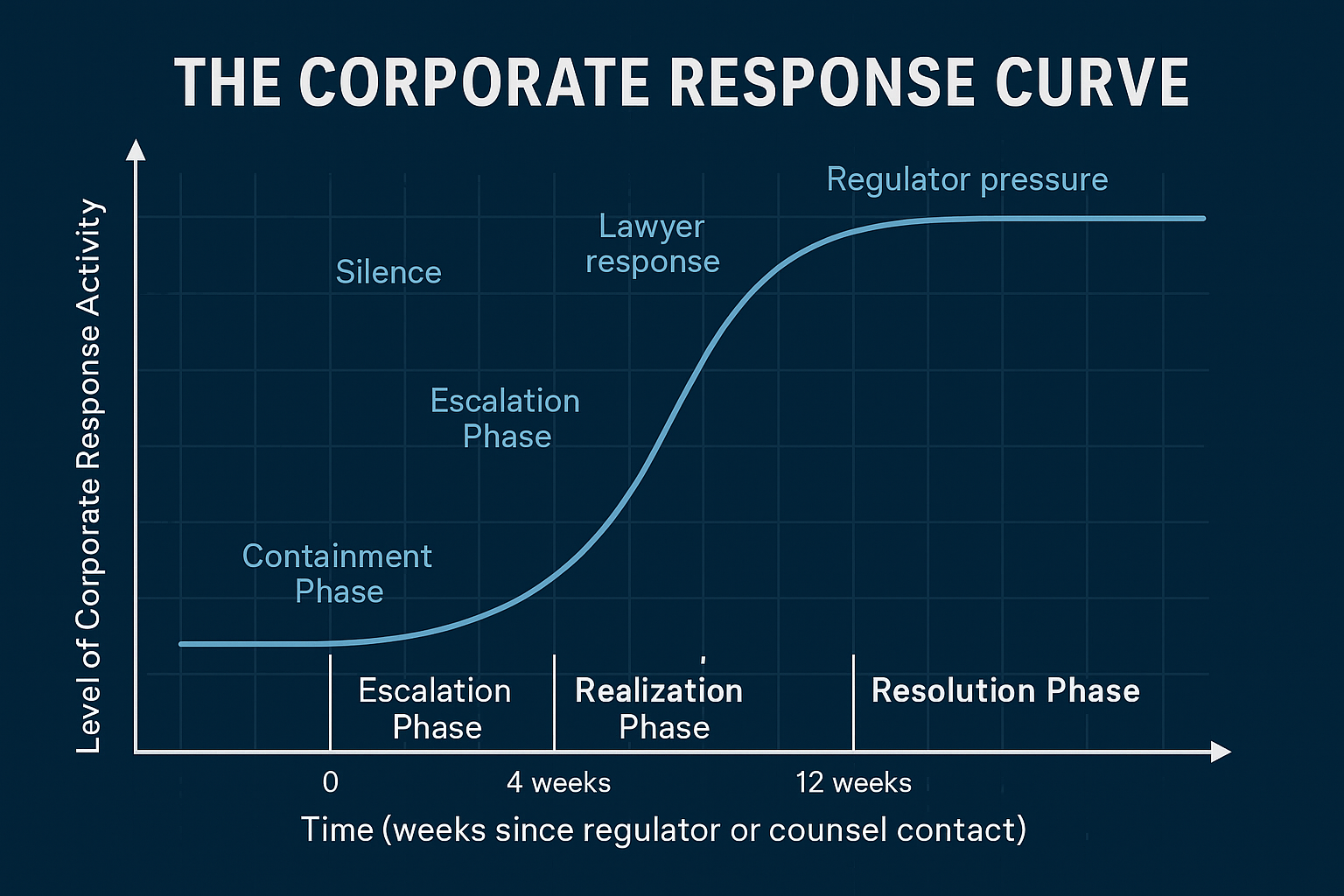

How corporations use procedural tools like“ongoing reviews,” “outside counsel opinions,” and “pending audits” to stretch accountability timelines until victims give up. - The Collapse Curve: How Internal Dynamics Predict Corporate Settlements

Mapping the typical timeline from denial to disclosure, showing how internal escalation eventually forces settlement through self-preservation rather than contrition. - Rebuilding the Balance: From Defensive Lawyering to Transparent Governance

The emerging model of companies using compliance and disclosure as proactive tools to prevent reputational and legal collapse.

Why It Matters

Most public discussions about corporate wrongdoing start after the damage is done.

By then, the harm is irreversible and the real decisions were made months or years earlier.

InvestorJustice.org’s goal is to shift the conversation from reaction to prevention.

Understanding how internal legal strategy, compliance behavior, and executive culture intersect is essential for creating systems that protect the public before harm occurs.

The Takeaway

Accountability doesn’t fail because people are bad. It fails because systems are built that way.

By making the invisible visible, The Corporate Dynamics Series gives readers, investors, regulators, journalists, and the public the tools to recognize structural warning signs before the next collapse happens.