Table of Contents

When the Legal Firewall Fails, Leadership Becomes Accountable

For decades, corporations have relied on complex legal and structural firewalls to insulate leadership from direct exposure. These layers, subsidiaries, holding companies and counsel intermediaries were designed to compartmentalize risk.

But in the modern regulatory era, the very mechanisms meant to protect leadership have become diagnostic clues for investigators and forensic accountants.

When regulators shine light through the maze, the illusion of separation dissolves. The firewall doesn’t protect, it maps the path to accountability.

The Myth of Plausible Deniability

Plausible deniability has long been the unspoken assumption behind corporate legal architecture: if a decision is routed through enough layers, the board can’t be blamed.

Yet in practice, the more elaborate the structure, the clearer the intent.

Every additional entity, intermediary, or counsel-to-counsel exchange becomes traceable evidence of strategic concealment or what regulators call “structured opacity.”

When oversight agencies connect those dots, plausible deniability collapses into provable design.

The Transparency Effect

Transparency doesn’t just expose misconduct; it reveals patterns.

In recent years, regulators have learned to follow digital breadcrumbs across jurisdictions, email routing, disclosure logs, audit trails, and shared legal inboxes.

Ironically, the attempt to centralize control through a single legal gateway, such as a shared “legal@company.com” alias, often accelerates exposure.

Once that address is used in regulator correspondence, it becomes a subpoena target and turns the entire legal department into a single point of evidentiary failure.

The old rule, “the fewer the points of contact, the safer the shield”, no longer holds true.

Now, fewer points mean faster discovery.

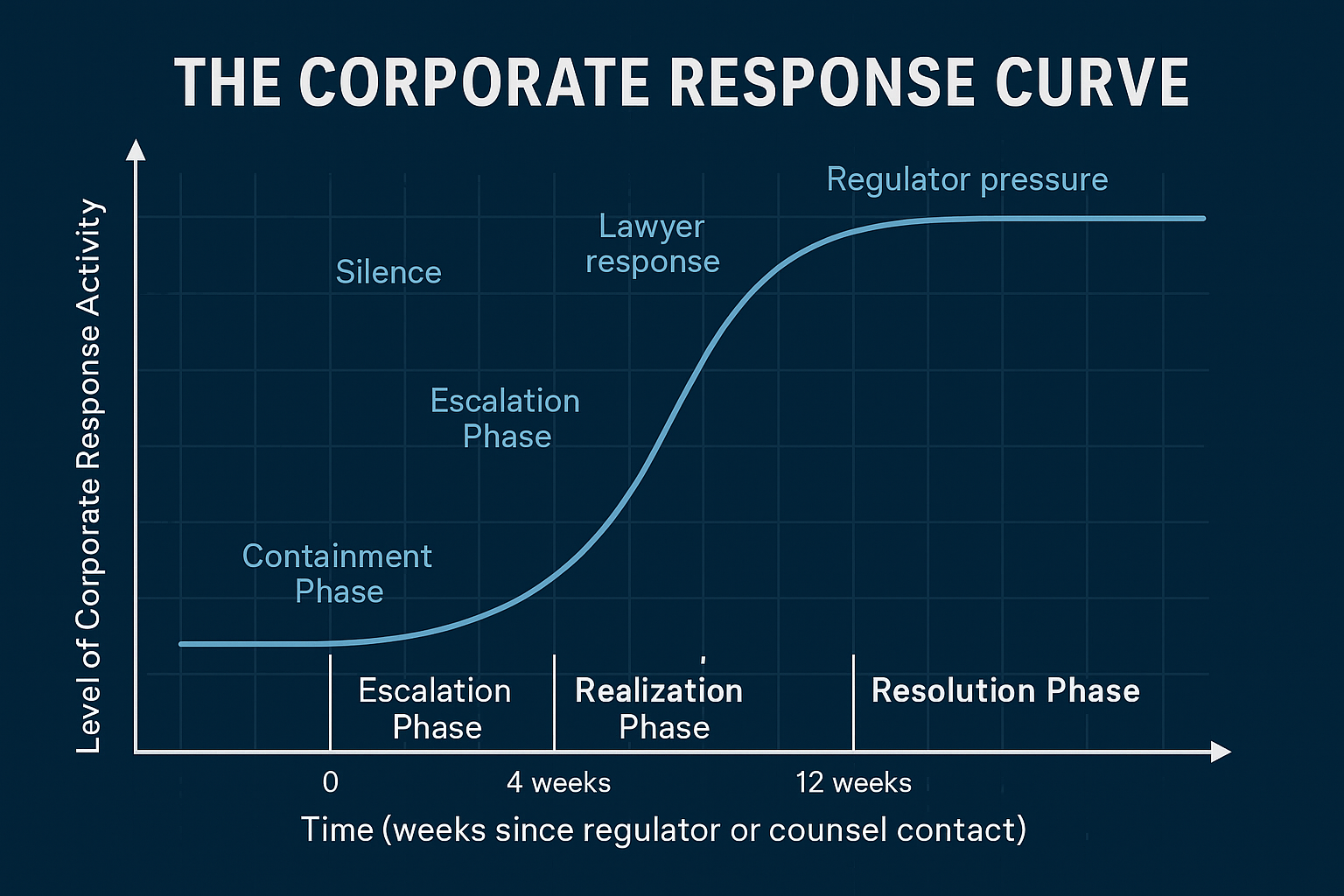

When Compliance Overrides Legal

Legal containment aims to manage exposure; compliance aims to eliminate it.

When regulators pressure firms, internal compliance officers and risk executives often override legal counsel to protect the institution’s survival, even at the expense of leadership.

This is where the firewall truly collapses: once compliance takes control, the company stops defending past behavior and starts negotiating accountability.

Settlements are no longer about avoiding blame; they become instruments of corporate triage.

The Governance Reckoning

Every failed firewall exposes a deeper truth: leadership culture defines compliance behavior.

When corporate systems treat ethics as optional or legal risk as a game, compliance becomes adversarial instead of protective.

In contrast, when leadership treats transparency as a stabilizing force, compliance functions as a shield for the organization, not against it.

The governance reckoning begins not when regulators arrive, but when leadership stops believing in its own legal mythology.

The Lesson for Regulators

For regulators, every complex defense structure is also a blueprint of where accountability hides.

Transparency reforms and disclosure mandates work not by punishing complexity, but by mapping it.

Once regulators can see how the walls are built, they can predict where they’ll crack.

The next generation of enforcement; empirical, data-driven, and jurisdictionally agile, won’t just pierce firewalls.

It will make them obsolete.