Table of Contents

InvestorJustice.org Editorial

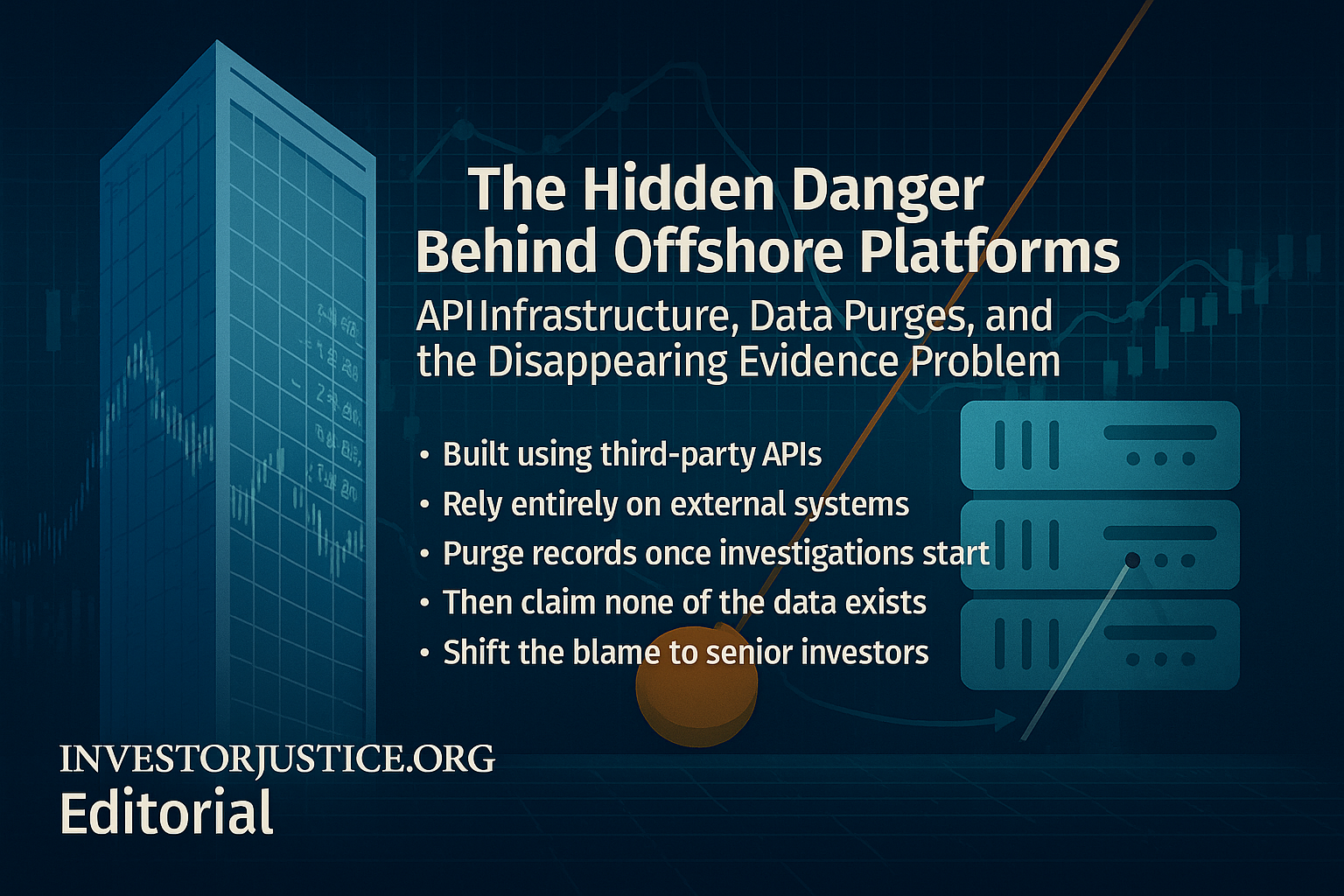

Offshore crypto lenders advertise themselves as innovative, fast-moving, and consumer-friendly. But their real advantage is something far less visible to the average American investor, an infrastructure built almost entirely on third-party APIs, external price feeds, liquidity partners, and custodial layers that allow them to grow quickly while avoiding the cost, responsibility, and accountability that regulated U.S. platforms must maintain.

This structure does more than create technical shortcuts.

It creates systemic risk, especially for retirement-age Americans whose life savings depend on accurate, verifiable account records.

When harm occurs, these platforms often cannot, or strategically will not, produce historical account data. Under the surface, there is a simple reason:

They never built the infrastructure to preserve it in the first place.

And when regulators close in, that data becomes a liability, not an asset.

The Business Model: Speed, Not Accountability

Offshore lenders compete by launching features faster than regulated financial institutions ever could. Their advantage comes from abstraction, outsourcing nearly everything:

What they outsource to external APIs

- price feeds

- margin/loan ratio calculations

- liquidation triggers

- exchange execution

- order routing

- portfolio valuation

- custody movements

- lending rate calculations

An American bank must store:

- every transaction

- every snapshot

- every risk metric

- every audit trail

- every customer record

- every compliance artifact

An offshore lender stores:

- whatever the API gives them

- when it gives it

- if they choose to log it at all

This is not an accident.

It is the business model.

APIs give platforms:

- low cost infrastructure

- instant scalability

- minimal engineering burden

- limited regulatory exposure

- outsourced KYC/AML buckets

- selective internal recordkeeping

It is intensely attractive for companies prioritizing growth over governance.

But it leaves consumers exposed.

Why API Reliance Makes Historical Records Disappear

When a platform’s entire valuation engine depends on external services, several things happen:

1. They do not control the data timeline.

If a third-party feed sends incorrect or missing data, the platform inherits it—and does not store the underlying source.

2. They cannot reconstruct what they never logged.

Many offshore lenders store only:

- daily snapshots

- balance summaries

- margin threshold outputs

- liquidation notices without source data

They do not store:

- price ticks

- collateral slope over time

- order routing proofs

- liquidation-pathing

- cross-exchange spread metrics

- risk exposure per second

This means if a customer disputes a liquidation, the platform cannot reproduce the underlying math.

3. They often purge logs when legal risk rises.

When:

- regulators inquire,

- investigators raid offices,

- civil litigation begins,

- or journalists start asking questions—

offshore lenders frequently “migrate systems” or “upgrade infrastructure” in ways that conveniently eliminate the audit trail.

In plain terms: once the data becomes dangerous, it disappears.

The Bulgarian Precedent: Why Platforms Purge After Raids

The 2023 raid on Nexo’s Bulgarian offices revealed a predictable pattern in offshore crypto firms:

- servers imaged

- data seized

- transaction logs examined

- custody flows mapped

- compliance gaps exposed

- legal risk skyrocketed

After such raids, platforms routinely:

- delete or purge historical logs

- rebuild systems in new jurisdictions

- wipe API-based transaction trails

- migrate data to uncooperative nations

- introduce “version 2.0” systems

- claim old data is “no longer available”

This is the same pattern seen in:

- Celsius

- Voyager

- FTX International

- Cred

- BlockFi offshore nodes

- Wirecard

- Quadriga

A platform that offloads everything to APIs can wipe history in minutes.

A regulated bank cannot.

Why Retirees Are the Most Vulnerable

Older Americans:

- have fewer working years left

- cannot recover large losses

- rely heavily on the appearance of safety

- cannot read complex Terms of Service

- trust dashboards over legal disclaimers

- assume account history is preserved

But offshore platforms are designed to obscure:

- liquidation mechanics

- margin triggers

- custody chain

- APR misrepresentation

- collateral valuation

- cross-jurisdictional accountability

Retirees cannot fight a company that claims:

“We have no record of your account.”

And offshore platforms know this.

Why Data Purges Are Not a Loophole—They Are Evidence of Misconduct

U.S. regulators, including DFPI, follow an established principle:

If a financial platform cannot produce account records,

the presumption shifts toward misconduct.

Offshore entities think deleting logs protects them.

In reality, it signals:

- obstruction

- non-cooperation

- willful evasion

- absence of internal controls

- potential consumer fraud

Regulators do not need the missing records to act.

The absence of records is itself a violation.

Especially in cases involving:

- senior consumers

- large losses

- cross-border evasion

- refusal to engage with investigators

- conflicting corporate statements

This is the core insight the public rarely sees:

Platforms build API-based systems because they are fragile.

They purge data because they are guilty.

The Public Must Understand the Pattern

This is no longer about one company.

It is the structural design of the offshore fintech industry:

1. Build fast using APIs

→ cheap, easy, no compliance burden

2. Grow aggressively through marketing

→ APR promises, “crypto credit lines,” unrealistic yields

3. Offload responsibility to terms and jurisdictions

→ Switzerland, Cayman, BVI, Malta

4. Avoid storing dangerous data

→ no evidence = no liability

5. Purge logs if investigations start

→ erase the past, deny accountability

6. Argue the consumer “accepted the risk”

→ through ToS that retirees cannot read or understand

This is not innovation.

It is avoidance architecture.

What Regulators and Policymakers Must Do

Regulators should treat offshore API-based platforms like:

- banks with missing records

- lenders with no loan files

- brokers with no trade history

- advisors with no suitability logs

In these situations:

The burden shifts to the platform.

Agencies must:

- presume misconduct when data is missing

- treat senior harm as exigent harm

- consider API-dependent systems as high-risk architecture

- accelerate enforcement for offshore evasion

- prohibit operations without verifiable ledgers

- treat data purges as an obstruction event

Most importantly:

A platform that cannot produce customer data cannot serve American consumers.

Period.

The Takeaway

Offshore lenders built a financial system designed for speed, not safety.

For growth, not governance.

For plausible deniability, not accountability.

API-based infrastructure makes platforms agile.

It also makes them unaccountable.

When the records disappear, the truth disappears with them.

And that is exactly the point.

This is why investor harm, especially senior harm, demands not just regulatory action, but structural reform.

Because the next time an offshore lender deletes its history, it won’t just erase data.

It will erase someone’s life savings.