Table of Contents

When Profit Becomes the Primary Risk Driver

Corporate systems are designed to reward growth, efficiency, and competitive advantage but rarely integrity.

When executive compensation, investor expectations, and short-term metrics dominate strategy, ethics becomes a cost center rather than a compass.

This is the foundation of what governance analysts call a liability-first culture: a system where managing exposure replaces preventing harm.

Legal departments can delay consequences, but they cannot indefinitely defend a business model that rewards risk faster than it can contain it.

The Mechanics of Misalignment

Modern corporations measure success in quarters, not consequences.

Boards and investors pressure executives for performance targets, creating structural incentives to:

- Optimize profit at the expense of transparency

- Overextend into high-yield but high-risk products

- Treat regulatory compliance as a tactical function rather than a core principle

Legal teams then become crisis managers, not ethical stewards.

Their role shifts from advising on legality to engineering plausible defensibility; an unsustainable posture when public scrutiny and regulatory capacity continue to grow.

The Compounding Effect of Short-Termism

Short-termism isn’t simply an accounting issue, it’s a governance pathology.

When every layer of an organization internalizes the message that “meeting targets” outranks “meeting standards,” small ethical compromises accumulate into systemic failures.

Each quarter that rewards riskier conduct without consequence reinforces the illusion that the system is stable, until it isn’t.

Once the underlying harm surfaces, leadership discovers that even the most sophisticated legal architecture cannot offset cultural decay.

How Legal Culture Enables the Cycle

Legal departments, by necessity, speak the language of risk.

But in liability-first cultures, that language becomes self-reinforcing.

When lawyers are rewarded for minimizing exposure rather than maximizing compliance integrity, they become structural enablers of the very behaviors they were hired to prevent.

The paradox:

- The better legal teams are at protecting leadership from consequence,

- The more emboldened leadership becomes to pursue the next profitable risk.

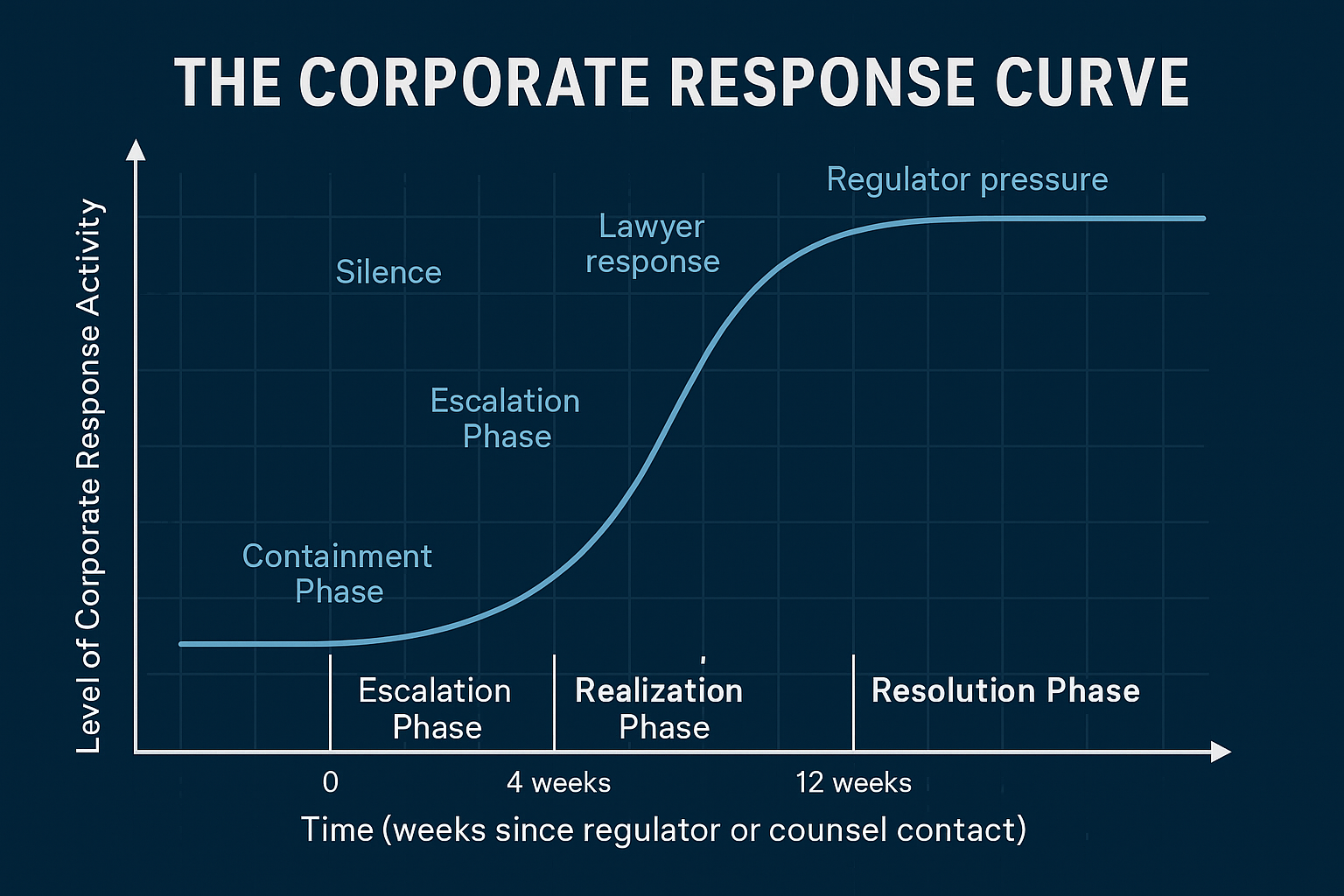

This feedback loop continues until an external force: regulator, journalist, or whistleblower interrupts it.

The Ethical Time Lag

Every firm operating under a liability-first model carries an invisible debt: the moral cost of deferred accountability.

This debt grows quietly, manifesting as suppressed disclosures, delayed investigations, and manipulated narratives.

By the time enforcement or public revelation occurs, the damage is not only financial, it’s civic.

Communities lose faith, regulators lose credibility, and entire markets absorb the shock of leadership’s moral negligence.

Rebalancing Incentives: The Path Out

Breaking the liability-first cycle requires structural redesign, not slogans.

Organizations that wish to outgrow this culture can:

- Tie executive bonuses to verified compliance metrics

- Mandate external ethics audits with transparent publication

- Integrate cross-departmental accountability boards that include compliance, risk, and public-interest representation

- Redefine legal success as risk prevention, not risk containment

Ethical profitability is not an oxymoron, it’s the only sustainable form of capitalism left.

The Civic Consequence

A liability-first culture doesn’t just threaten shareholders.

It corrodes democracy by teaching the public that rule-makers and rule-breakers belong to the same club.

Investor Justice exists to expose that illusion and to rebuild public trust by proving that accountability is not the enemy of profit, but its guarantee.