Table of Contents

InvestorJustice.org | Enforcement Ethics Series

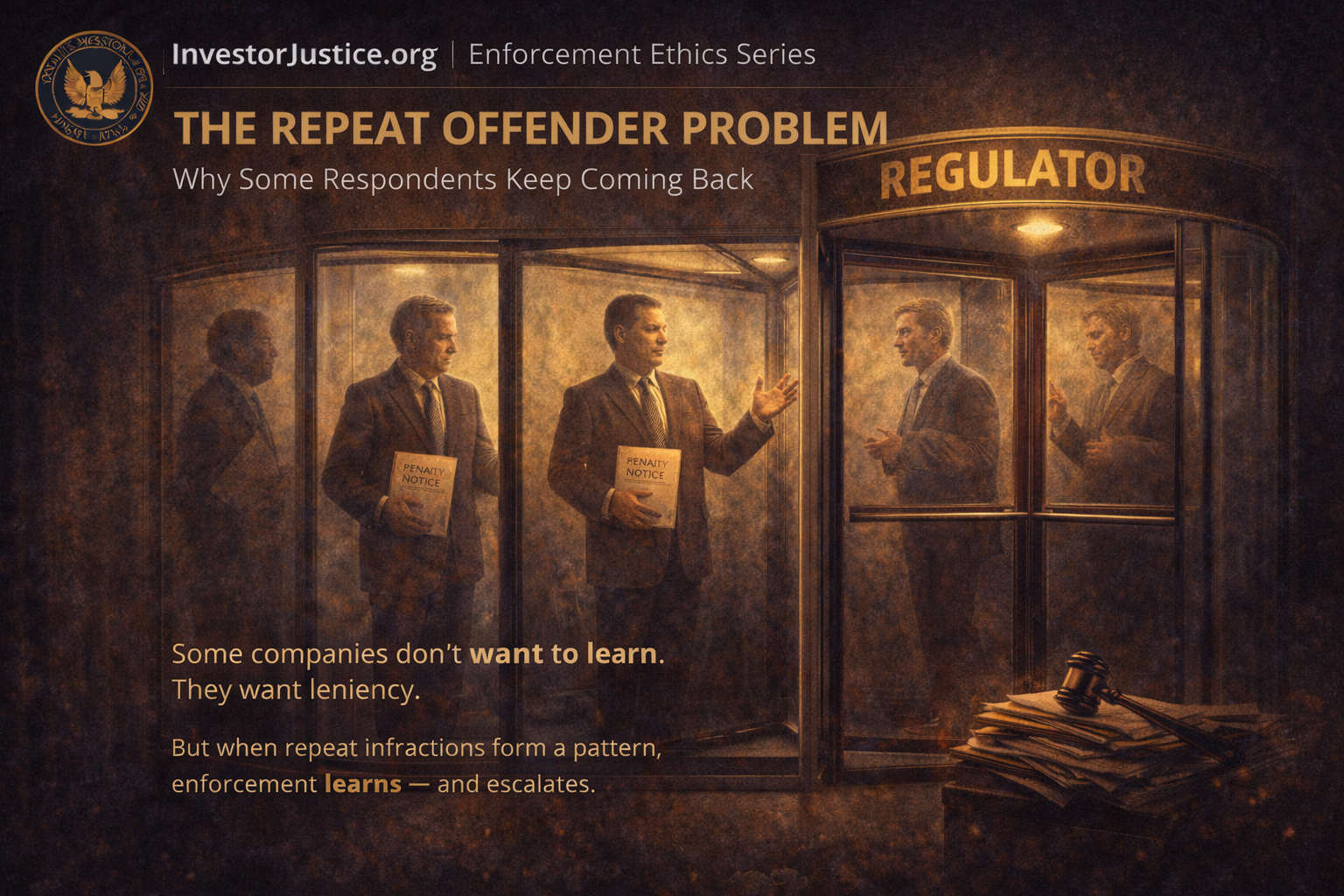

Some companies don’t learn. Others don’t want to.

Regulators know this. And over time, patterns emerge, not just in consumer complaints, but in how certain platforms behave after those complaints are filed.

These are not one-time mistakes or early-stage oversights. These are respondents who treat regulatory enforcement like a scheduling inconvenience. A risk of doing business. A badge of survivability.

The Revolving Door Respondent

For certain platforms, especially those operating in crypto, high-yield lending, or cross-border finance, the playbook is familiar:

- Push the boundary of what’s legal.

- Profit from the gray zone.

- Delay when challenged.

- Settle narrowly and spin the result as “clarification,” not wrongdoing.

- Then repeat the cycle with new terms, new products, or new legal fronts.

By the time regulators re-engage, the playbook is already back in motion. And so the cycle continues, not because the facts are unclear, but because the platform has built its strategy around repeat proximity to the line.

What Regulators Learn From Patterns

Regulatory bodies like the California DFPI are not blind to repetition. When a company appears before them again and again:

- They know it’s not an isolated mistake.

- They understand the respondent is weighing the cost of compliance against the profit of delay.

- And they begin to treat every claim, record request, or legal argument through the lens of prior behavior.

This changes everything.

Repeat misconduct changes:

- Timelines: Less tolerance for delay.

- Tone: Less patience for “cooperative” language masking obstruction.

- Consequences: Fines, penalties, or public disclosure that would have been optional the first time become necessary the second or third.

Why Leniency Diminishes With Repetition

Regulators, like judges, are bound by precedent and not just legal precedent, but behavioral precedent.

When a company previously agreed to:

- Cooperate fully,

- Implement controls,

- Cease deceptive marketing,

- Or clarify misleading terms…

… and then returns months or years later with new infractions or continued opacity, leniency is no longer logical. It's dangerous.

Because at that point, the regulator isn’t just dealing with a policy issue. They’re dealing with a credibility issue.

The Quiet Shift: When Enforcement Prepares to Escalate

When a repeat respondent resurfaces:

- Silence gets quieter.

- Demands get sharper.

- Deadlines get shorter.

- And the internal posture changes from caution to control.

This often happens behind closed doors. But for the respondent, it means the usual delay tactics no longer apply because the regulator knows what they’re dealing with:

A platform that has already had its warning.

The Takeaway

Some companies don’t need more education.

They need accountability.

Regulators have the right and the responsibility to escalate when misconduct repeats, especially when retirement-age or vulnerable consumers are harmed.

If a platform keeps returning to the same regulatory table, asking for leniency with one hand while delaying with the other, the time for patience ends.

The only way to stop a revolving door is to close it.

InvestorJustice.org

Because patterns tell the real story.