Table of Contents

InvestorJustice.org | Enforcement Ethics Series

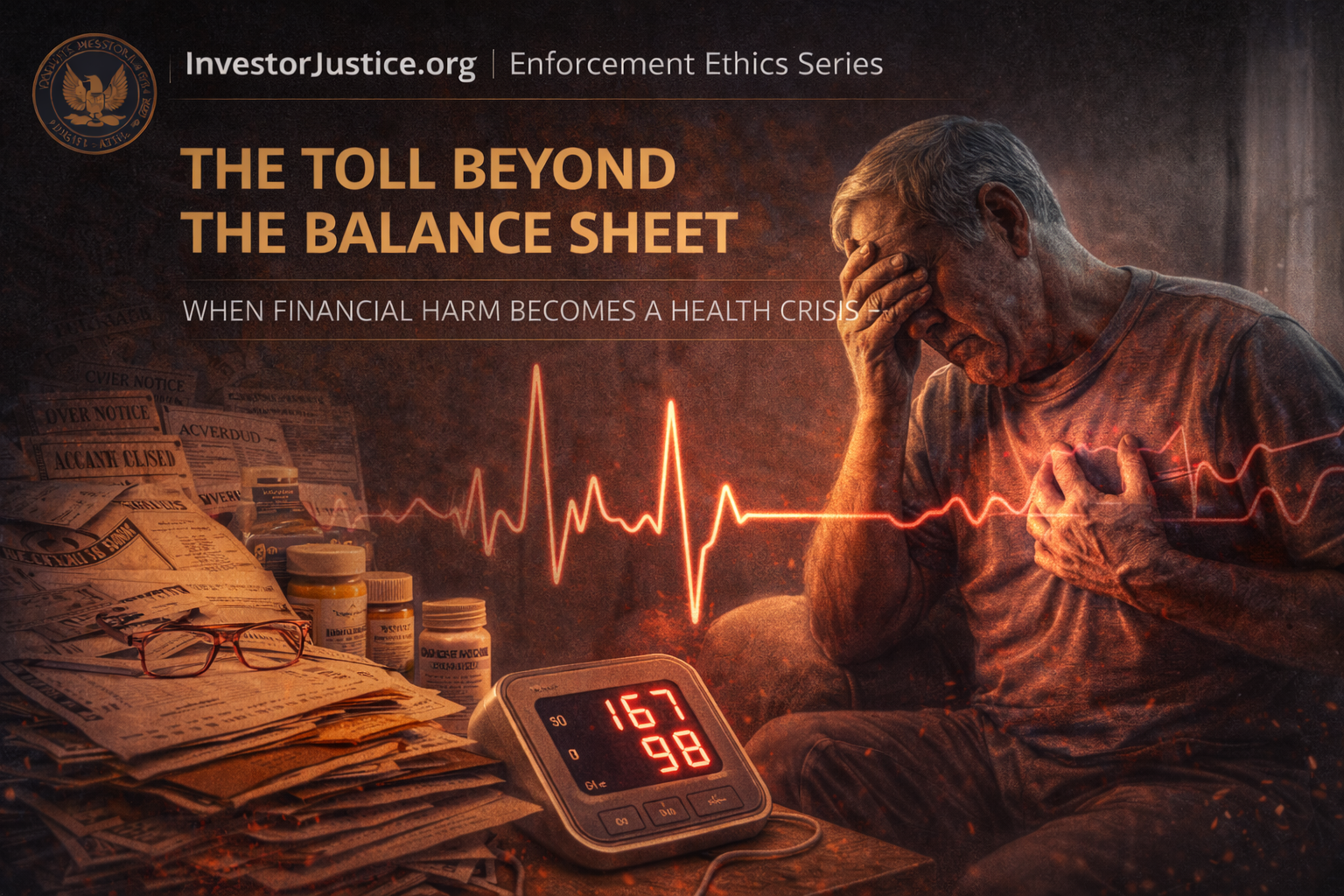

For many retirement-age investors, the harm caused by financial misrepresentation doesn’t end with a depleted account. It becomes something deeper and far more dangerous.

It becomes a health crisis.

When the Body Bears the Burden

Misleading platforms often assume their deception will be measured in dollars. But the reality for many older consumers is that financial betrayal triggers:

- Insomnia and chronic stress

- Anxiety and panic episodes

- Blood pressure spikes and heart complications

- Isolation, shame, and depressive symptoms

These are not hypothetical outcomes. They are common and often documented in cases of elder financial exploitation.

The body keeps the score. And the longer justice is delayed, the heavier that score becomes.

The Vicious Cycle of Shame and Silence

One of the cruelest effects of being misled is the self-directed blame that follows:

“How did I fall for this?”

“Why didn’t I ask more questions?”

“Maybe I deserved this for not understanding.”

This internalized shame:

- Keeps victims from seeking help,

- Deters reporting to regulators,

- And compounds the emotional damage.

But here’s the truth: deception is designed to look trustworthy. Platforms that manipulate APR disclosures or deflect accountability are not clever, they are calculated. They rely on plausible optics and legal distractions. Falling for that isn’t foolish. It’s common.

What Regulators Must Understand

Every delay in enforcement, every unreturned call, every unanswered submission, these are not just bureaucratic pauses. They are health risk factors for the harmed party.

- Stress doesn’t wait for enforcement to catch up.

- Cardiac risk increases with prolonged anxiety.

- Mental health deteriorates in silence.

Consumer protection is health protection. And regulators must treat it that way.

The Takeaway

Misrepresentation doesn’t just steal equity, it steals well-being.

The pain that follows is not just financial. It's physical. It's emotional. It's real.

If regulators want to fulfill their mandate, they must look beyond the balance sheet. Because the real cost of financial abuse is often hidden in hospital visits, pill bottles, and sleepless nights.

And the longer a case sits unresolved, the more that cost grows.

InvestorJustice.org

Because no one’s health should suffer for someone else’s deception.