Table of Contents

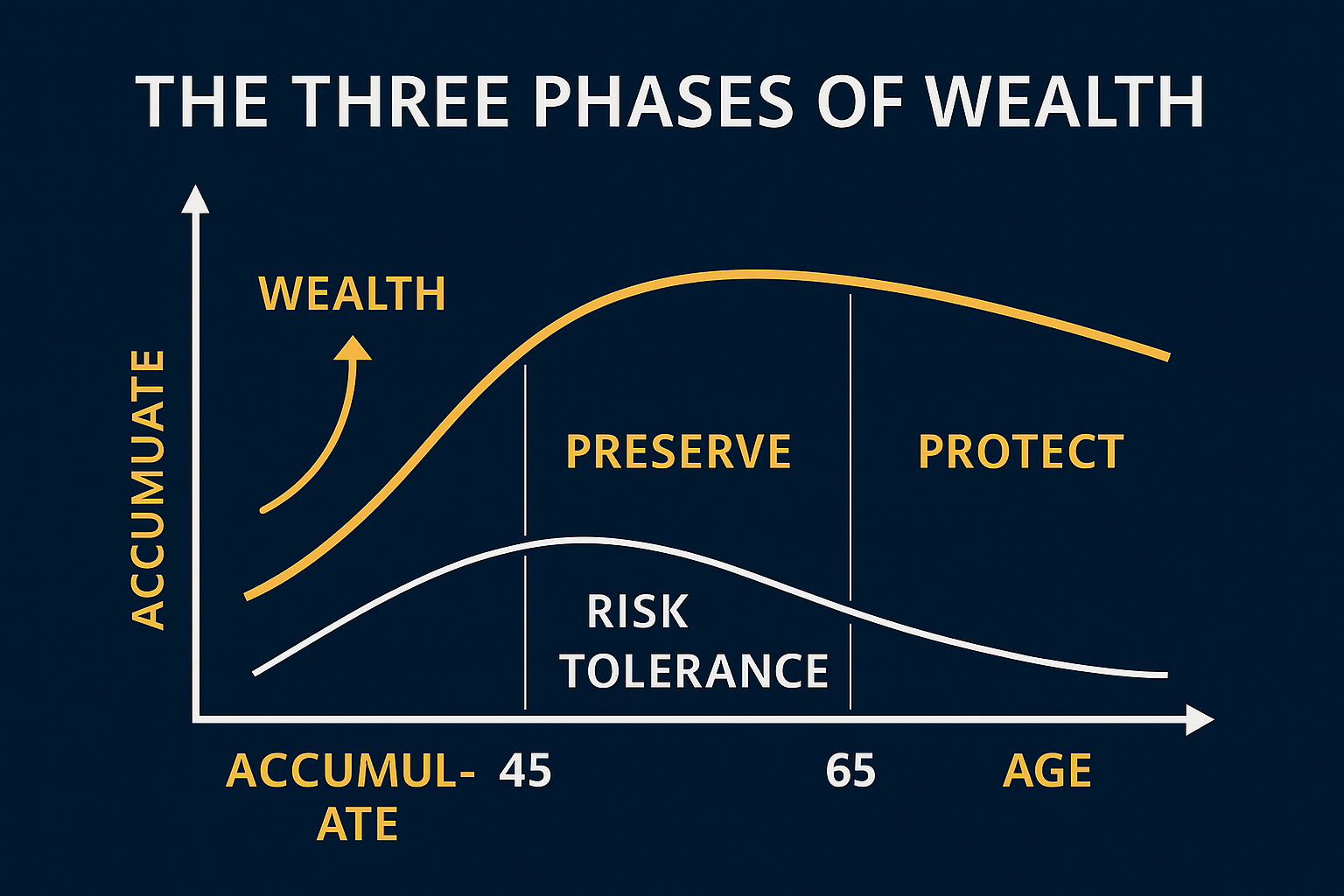

Understanding where you are in the wealth cycle and how much risk you can afford to take.

1. The Principle: You Can’t Protect What You Haven’t Built

Wealth isn’t just about money, it’s about stability.

The same way your health evolves through stages, your financial life does too.

Each stage requires different priorities, protections, and behaviors.

This primer helps you map your position in the Wealth Lifecycle, so you can make smarter, safer investment choices and recognize when to shift from growth to preservation.

2. Phase One: Accumulation (Ages ~20–45)

Goal: Build the foundation.

This is the wealth-building stage: your career, savings habits, and first investments set the tone for everything that follows.

Risk tolerance is naturally higher, but so is vulnerability to poor decisions and misinformation.

Core Priorities

- Maximize savings rate and reduce high-interest debt.

- Invest in education, skills, and stable income growth.

- Use diversified, transparent investment vehicles, not speculative “opportunities.”

- Focus on liquidity: avoid locking away funds you might need.

Common Mistakes

- Chasing fast gains without understanding risk.

- Believing social media “advice” over regulated guidance.

- Failing to track fees and data transparency.

Checklist

✅ Emergency savings = 6+ months

✅ Defined retirement contribution plan

✅ Debt ratio below 30% of income

✅ Transparent, verifiable investment platforms

3. Phase Two: Preservation (Ages ~45–65)

Goal: Protect what you’ve built.

This is the most fragile phase of wealth.

There’s still room for growth, but the focus must shift to risk management, data reliability, and verifiable transparency.

Every dollar lost now requires exponentially more effort to recover.

Core Priorities

- Rebalance portfolio for stability and income.

- Verify regulatory oversight of all platforms.

- Track where your data — and your money — actually resides.

- Minimize exposure to unregulated or offshore entities.

Common Mistakes

- Staying overexposed to high-volatility assets.

- Failing to obtain account-level records from custodians.

- Ignoring tax and jurisdictional implications of online investment tools.

Checklist

✅ Written, verifiable asset allocation plan

✅ Regular third-party review of accounts

✅ Backup copies of all transaction data

✅ Known jurisdiction and recovery process

4. Phase Three: Protection (Ages 65+)

Goal: Ensure security and legacy.

At this stage, rebuilding after loss may be impossible.

The priority is capital integrity, income consistency, and safe transfer mechanisms.

Core Priorities

- Move toward low-risk, transparent holdings.

- Establish power-of-attorney and trusted data custodianship.

- Focus on data continuity as your heirs or advisors must know what you own and where it’s held.

- Verify estate documentation aligns with current account records.

Common Mistakes

- Assuming long-standing institutions are automatically safe.

- Delegating without oversight.

- Failing to maintain access credentials or account logs.

Checklist

✅ Monthly income exceeds monthly costs

✅ Power of attorney or trustee in place

✅ Updated will and account record log

✅ Clear contact points for each custodian

5. Rebuild Reality: The Ability to Recover Shrinks Over Time

Rebuilding after financial harm is possible but increasingly difficult with age.

A $100,000 loss at 35 can often be replaced; at 65, it can end retirement security.

That’s why InvestorJustice.org advocates age-based risk awareness as a core investor protection principle.

Your exposure to risk should decrease as your ability to recover diminishes.

| Age Range | Risk Profile | Recovery Capacity | Focus |

|---|---|---|---|

| 20–35 | High | Strong | Growth, learning, diversification |

| 35–50 | Moderate | Declining | Balance growth with protection |

| 50–65 | Low | Limited | Preserve and secure data |

| 65+ | Minimal | Very limited | Protect, document, and transfer |

6. The Transparency Factor

No matter your age or phase, one constant applies:

Transparency is the ultimate insurance policy.

If you can’t access or verify your account data, you don’t truly own it.

Wealth protection begins with data protection; the foundation of every InvestorJustice checklist, tool, and advisory.

7. The Bottom Line

You can’t time the market, but you can time your exposure.

Understand your stage. Protect your data. Demand transparency.

Building wealth takes years; losing it can take minutes.

Use each phase to prepare for the next and ensure that your future self doesn’t pay for today’s blind spots.

![[PDF] Addressing the Risks of Nexo to Swiss Banking and Regulatory Reputation - Case 2025-000001](https://cdn.mymidnight.blog/14d9e8007c9b41f57891c48e07c23f57/2025/10/IMG_5212-8.png)