Table of Contents

InvestorJustice.org | Editorial Series

It’s one thing to experience financial harm.

It’s another to be asked to relive it over and over just to be heard.

For many consumers, especially older ones, the regulatory process adds insult to injury. The promise of protection becomes a gauntlet of repetition, delay, and silence.

The Loop of Repetition

When claimants are told to:

- Re-upload documents

- Re-explain what went wrong

- Wait without updates

- Follow up without acknowledgment

…it creates a toxic loop where the process itself becomes traumatic.

This isn’t about impatience.

It’s about exhaustion. It’s about being asked to fight uphill in a system that already failed once and now seems indifferent to the harm it allowed.

Worse still, every interaction feels like starting from zero.

No continuity. No validation. Just another reminder that your evidence, your story, wasn’t enough to trigger urgency.

Bureaucracy Can Become Its Own Harm

The silence of regulators doesn’t just slow justice.

It erodes the health of the harmed.

- Chronic stress and insomnia

- Anxiety and cognitive strain

- Isolation and emotional withdrawal

- Elevated cardiac risks and physical symptoms

These are not abstract outcomes. They are real, documented responses to prolonged inaction, especially among retirement-age victims of financial deception.

And yet, the system offers little acknowledgment of this cost.

Each week without an update says, implicitly:

“You’re not a priority.”

But in most cases, the evidence was enough.

It’s the system that isn’t built to act swiftly or compassionately.

The Psychological Weight of Not Being Believed

When a regulator remains silent after you’ve done everything right, it can start to feel like gaslighting.

You question:

- Did I misread the harm?

- Did I submit the wrong thing?

- Was it my fault after all?

This erosion of confidence is the hidden damage of bureaucracy.

And it’s one that disproportionately affects honest, older victims, the ones who still believe in systems, in fairness, in process.

What Must Change

- Acknowledgment is not optional.

A simple message can prevent despair. Silence cannot be the default. - Processes should reduce harm, not compound it.

If a system requires more emotional labor than the original scam, it has failed its mission. - Repeat victims need procedural shortcuts, not hurdles.

A regulator that has seen a respondent before should not pretend it’s the first time.

The Takeaway

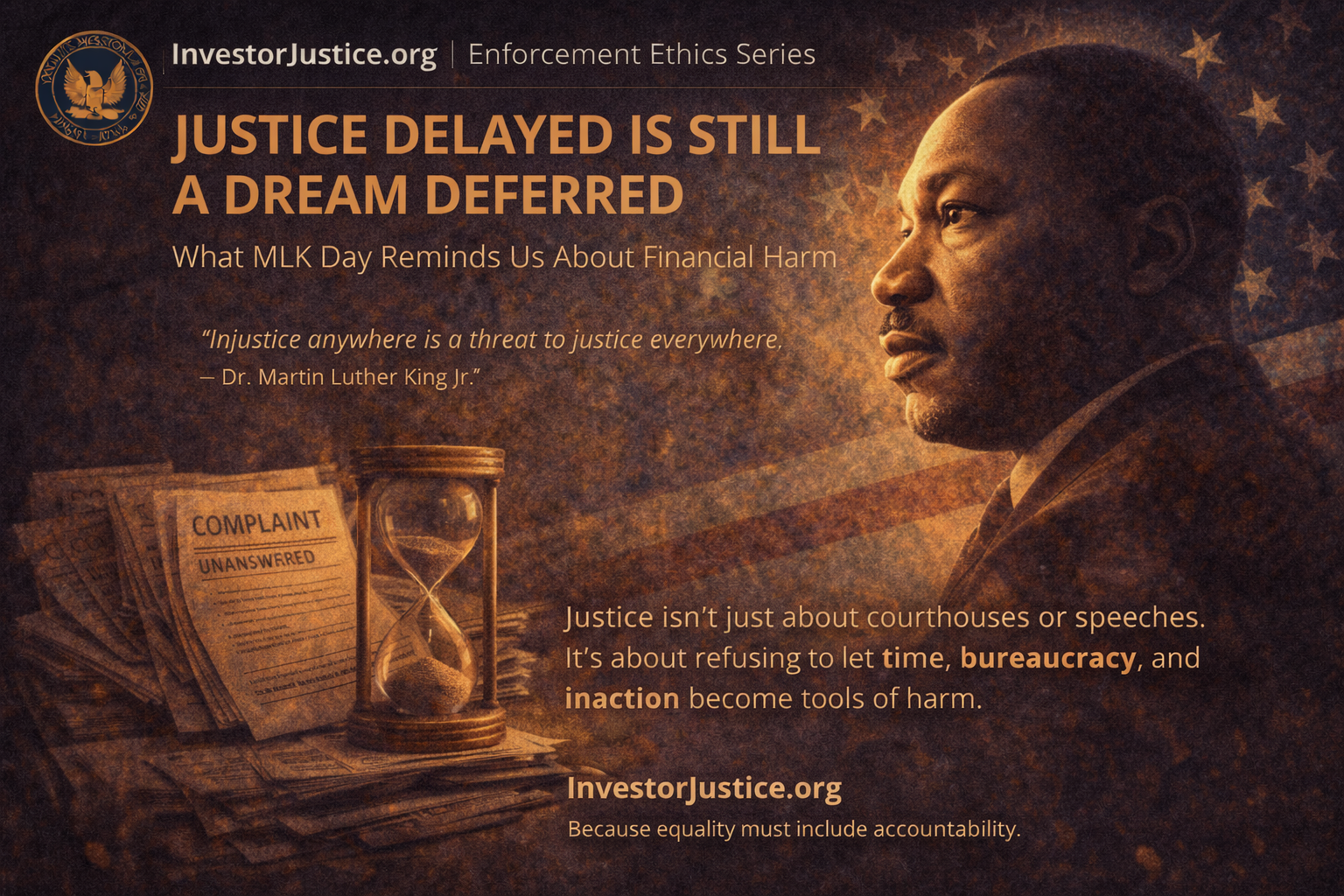

When the process becomes the punishment, justice isn’t delayed, it’s denied.

Investor protection doesn’t end with receiving a complaint.

It begins with what happens next.

And what happens next must be human not just procedural.

InvestorJustice.org

Because bureaucracy should not break the people it’s meant to protect.