Table of Contents

The Corporate Shield

Inside most financial and fintech institutions, the legal department functions as both moat and archers: it keeps regulators, litigants, and public scrutiny at a distance long enough for leadership to stay focused on growth.

That moat works — until it doesn’t.

When regulators or Tier-1 counterparties force escalation beyond Legal, the protective layer dissolves.

What was once a defensive perimeter becomes a spotlight.

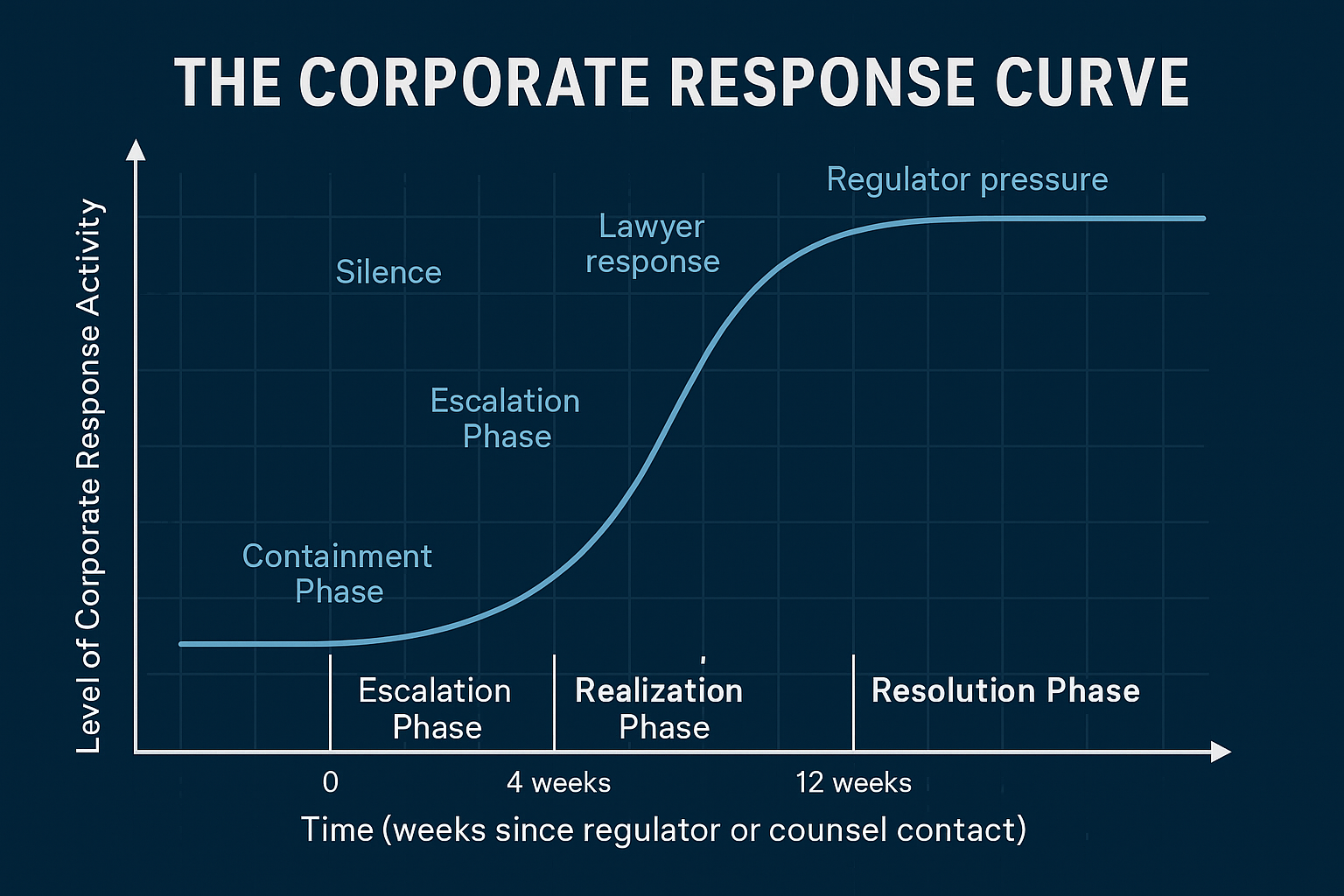

The Shift: From Containment to Exposure

Legal teams are tactical. Their job is to control information flow, frame language, and manage time.

But once Compliance or Risk teams have to brief executive leadership, everything changes.

At that moment, the narrative stops being “a legal matter” and becomes “a governance matter.”

Facts that were privileged now translate into knowledge at the leadership level, triggering direct fiduciary duties.

Under corporate-governance law in both U.S. and Swiss frameworks, executives can rely on counsel’s advice but not on counsel’s ignorance.

Once they know or should have known, deniability evaporates.

Plausible Deniability and Its Collapse

Plausible deniability only exists while a problem remains “contained.”

The instant Compliance or Risk teams raise the issue at the board table, leadership is deemed to have knowledge.

From that point forward, the question regulators ask is no longer:

“What did Legal do?”

but rather:

“What did leadership do after being informed?”

That shift transforms a compliance oversight into potential executive negligence.

The Chain Reaction Inside the Company

When escalation occurs, self-preservation mechanisms ignite:

- Compliance documents that it warned leadership.

- Risk quantifies potential exposure.

- Audit logs the governance response for internal review.

Each function now creates discoverable records that regulators can later subpoena.

Legal’s protective fog becomes a map of awareness.

Leadership’s New Incentive

Before escalation: silence minimizes attention.

After escalation: silence maximizes liability.

Once top management knows of regulatory exposure, ignoring it can be construed as willful negligence.

That’s when leadership typically pivots to a quiet settlement or consent resolution, not because they suddenly embrace accountability, but because it becomes cheaper than continued denial.

The incentive structure flips.

Why This Matters for Investor Protection

For ordinary investors and consumers, understanding this shift is critical.

It explains why corporate settlements often appear sudden or opaque:

they aren’t moral awakenings, they are structural inevitabilities once the firewall of plausible deniability collapses.

InvestorJustice.org’s mission is to expose that machinery so the public understands how governance pressure, not goodwill, creates reform.

The Lesson

“When Legal loses control, accountability ceases to be optional.”

The moat can hold off scrutiny for years, but once the arrows stop flying, daylight reaches the castle walls.

And daylight, not paperwork, is what finally changes behavior.