Table of Contents

InvestorJustice.org | Regulatory Timing Series

Time is not neutral.

For retirement-age investors, delay is often the harm.

Time Pressure Unique to Seniors

Retirees face:

- Medical deductibles that reset each January

- Financial planning tied to housing and benefits cycles

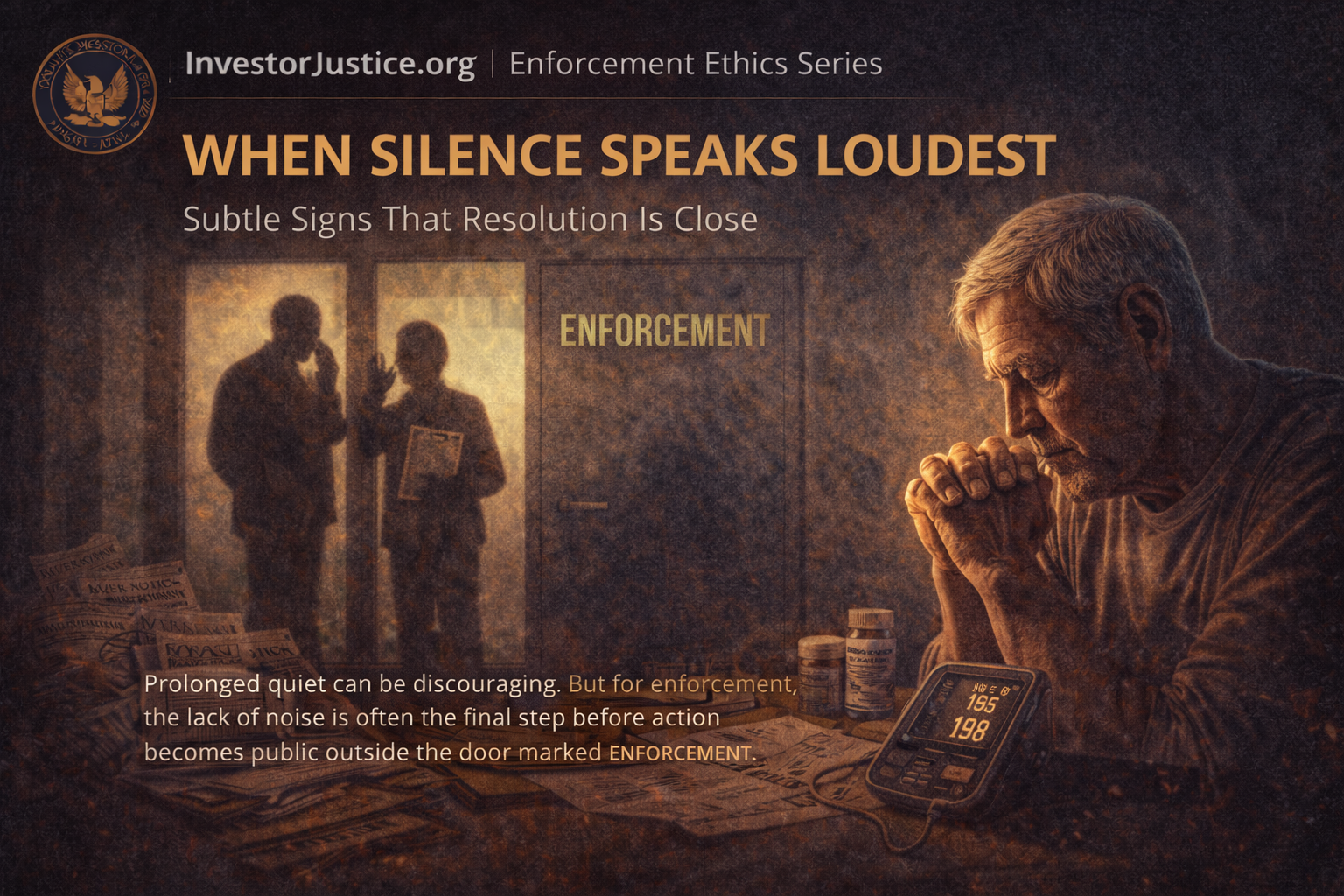

- Increased medical risk from prolonged stress

- Reduced capacity to recover from unexpected loss

What may be a 12-month inconvenience for a younger investor is an irreversible crisis for a 72-year-old.

Why Regulators Must Prioritize by Age

California and federal regulators already have the power to:

- Prioritize based on consumer vulnerability

- Escalate cases involving missing records

- Penalize offshore deflection tactics

But too often, retirement-age investors are treated like any other case with timelines designed for corporations, not people with limited time.

The Case for Urgency

A 6-month delay may mean:

- Loss of housing

- Inability to qualify for benefits

- Cascading financial and medical harm

- Mental health deterioration

This isn’t anecdotal. It’s documented reality in elder financial abuse cases and regulators must act accordingly.

The Takeaway

Aging is not exceptional.

It is predictable and consumer protection must reflect that truth.

Regulators don’t need new laws.

They need a new sense of timing.